Your Adventure Awaits

Congratulations! You're taking the first steps towards earning miles and free travel. While there are many ways to pursue those points, we'll show you how we get it done.

Things To Note:

- You absolutely must pay off your statement balance every month. The amount you pay in interest negates any potential gain you would get with the points. This one is very important and quite easy to do. We set up our payments automatically through the card issuer’s app and pay directly from our bank account; essentially paying bills while earning points.

- Opening multiple cards doesnt hurt your credit. In most cases, if it is done right, your credit score can increase. There are rules with certain companies; Chase Bank for example, where the number of cards you can open in a certain amount of time is limited. We can get into the details of that later… just know it exists.

- Business Cards: A business can be something as simple as selling items on Facebook Marketplace or Ebay, selling baked goods, or owning a small landscaping company. Pro tip – when applying for a business card, you can use your social security number in place of the EIN. Also, answer all questions honestly; you do not need to be making a ton of money selling things to qualify for a business card.

- Building a solid points foundation is a marathon, not a sprint. Good timing and planning as well as excellent execution is the key to building and maintaining your ability to travel for next to nothing long term.

Featured Cards

Chase Sapphire Preferred Card Referral

Apply Here Our favorite deal right now is the Chase Sapphire Preferred card. This card is one of the best starter cards in the points game. When you sign up for this card and spend $4,000 in 3 months, you will receive a 60,000 point sign-up bonus. Also important to...

Capital One Venture X Referral

Apply Here Capital One Venture X Here are the details: Earn 75,000 points after spending $4,000 in the first 3 months. That’s at least $750 towards travel, and if done right, you can get more than $1350 in value. Annual Fee $395 Receive a $300 annual statement credit...

American Express Platinum Card Referral

Apply HereApply for an American Express Card with this link. We can both get rewarded if you're approved! American Express Platinum American Express Platinum Card Sign-up bonus – 80,000 membership reward points ($1200 value) The minimum spend requirement is $8000 in 6...

Maximizing Rewards: Double Dipping with Rakuten and Amex

Introduction:

Double-dipping into the salsa at a party is just gross, but double-dipping when it comes to earning points is AMAZING! Whether you're a seasoned points collector or just starting your pursuit, this strategy can help you maximize rewards with every purchase.

Table of Contents

Understanding the Partnership between Rakuten and American Express Membership Rewards:

Before diving into the details, let's first understand the basics of Rakuten. This is a popular online platform that offers cashback on everyday purchases. Check out the link here to get started.

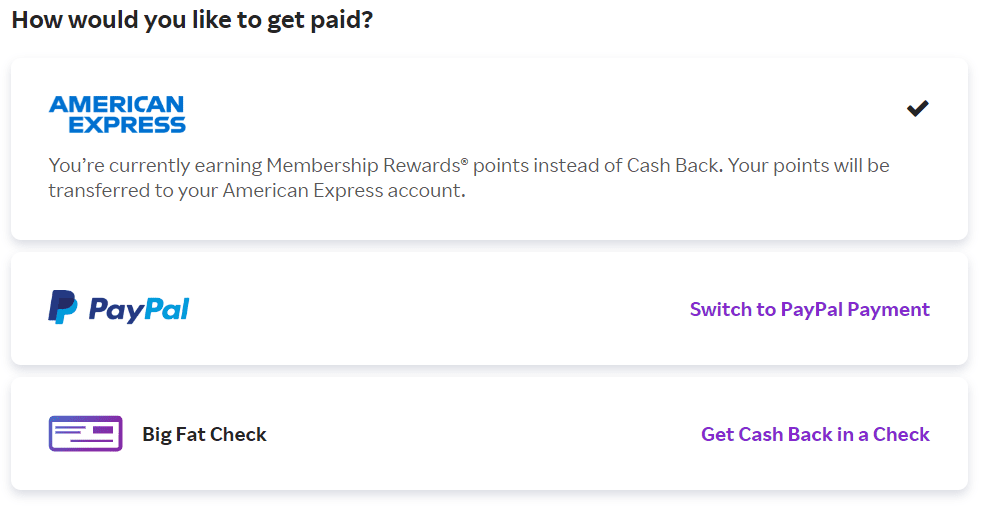

Rakuten has a unique partnership with American Express, and because of this, you can earn AMEX Membership Rewards points instead of cash back on Rakuten. This is a huge benefit that most Rakuten users are not aware of. By making this easy adjustment from cashback to points, you can significantly increase the value you receive from Rakuten. If you're looking for a great American Express card that earns MR points, look no further; here is a great starter card.

How to Link Rakuten with American Express:

The first step in maximizing rewards is to link your Rakuten account with your American Express card. Here's how to do it:

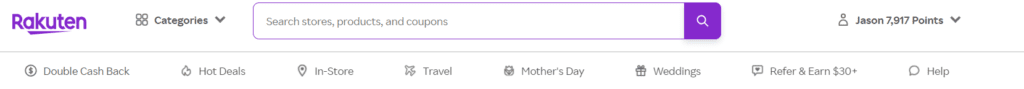

- Log in to your Rakuten account.

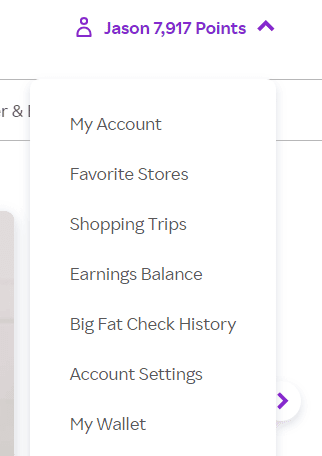

- 2. Navigate to the upper right corner where your name is, hover over it, and click on “Account Settings.”

- 3. Scroll down until you see “How would you like to get paid?” and select American Express.

- 4. Follow the prompts to link your American Express card to your Rakuten account.

By linking your accounts, you ensure that you earn Membership Rewards points with American Express on qualifying purchases. This simple step sets the foundation for maximizing your rewards.

Maximizing Rewards the Double Dipping Strategy:

Now that your accounts are linked, it's time to implement the double-dipping strategy:

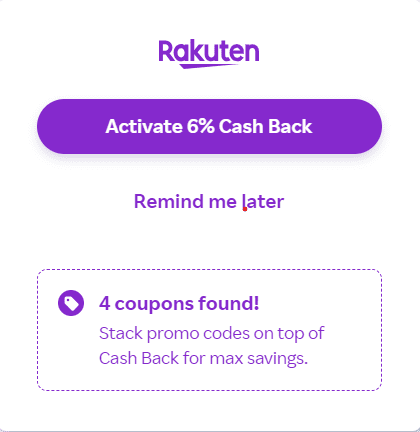

The easiest way to do this is to add the Rakuten extension to your browsers. You can activate this function when you log into your Rakuten account. Then, anytime you open a site that offers cashback with Rakuten, it will prompt you.

Otherwise, you can load up Rakuten's site and activate cashback. The latter is much easier and seamless, so you don't miss any opportunities. However, if you decide to do it manually, here are the steps:

- Start by accessing Rakuten.com before making any online purchases.

- Browse through the list of retailers offering cashback rewards.

- Select a retailer and click through Rakuten to make your purchase.

Double-dipping comes into effect as long as you click through Rakuten. You are earning your Membership Rewards with Rakuten, which will be dumped into your Amex MR points balance quarterly, along with the points you earn from the credit card purchase. (The purchase can be made on any credit card; it doesn't have to be an Amex card.) We suggest using a card with the best point multiplier for your purchase to get the best value. Here is a link to some of our favorite cards.

Tips for Shopping Smart with Rakuten and American Express:

To get the most out of this strategy, consider the following tips:

- Keep an eye out for special promotions and bonus offers on Rakuten. Promotions happen all the time around Holidays.

- Plan your purchases strategically to take advantage of higher cashback rates.

- Regularly check for new retailers added to the Rakuten network.

- Pay attention to any terms and conditions to ensure eligibility for maximizing rewards.

Conclusion:

Combining the power of Rakuten and American Express Membership Rewards can significantly boost earning valuable points on your everyday purchases. Start implementing these strategies today, and watch your rewards pile up!

Your Adventure Awaits – Posts

Maximizing Rewards: Double Dipping with Rakuten and Amex

Introduction: Double-dipping into the salsa at a party is just gross, but double-dipping when it comes to earning points is AMAZING! Whether you're a seasoned points collector or just starting your pursuit, this strategy can help you maximize rewards with every...

Credit Card Annual Fees: Are They Worth It? Insider Tips for Making the Right Call

Credit Card Annual Fees: Are They Worth It? Insider Tips for Making the Right Call Credit card annual fees can suck. Once a new card has been open for 12 months, you must decide whether it has enough value to keep it open and continue paying the annual fee....

Unlocking the Secrets: Rapid Strategies to Earn Maximum Credit Card Points

Unlocking the Secrets: Rapid Strategies to Earn Maximum Credit Card Points When conversing about frequent travel and accumulating points, the inevitable question arises: "How do you earn enough points to travel as much as you do?" The Pursuit of Points can be a...